Background

Marginal fields in the petroleum industry are fields which have remained unattended for a period of more than ten (10) years, from the date of first discovery of petroleum products or such fields as the President may, from time to time, identify as being a Marginal Field. For additional background information regarding marginal fields and general key issues to consider during bid rounds, please click on the following links to access Detail Com-mercial Solicitors’ contributions on this topic: Oil and Gas Guide 2014 Edition; Oil and Gas Guide 2018 Edition and our 2019 Oil & Gas contribution to Chambers Global Practice Guide.

NEW DEVELOPMENTS

In June 2020, the Department of Petroleum Resources (“DPR”), on behalf of the Federal Government of Nigeria, announced the commence-ment of the 2020 Marginal Field Bid Round exercise (the “Bid Round”), which is open to indigenous companies and investors interested in participating in Exploration and Production (“E&P”) business in Nigeria. Following the announcement, the DPR has released the 2020 Guidelines for the Award and Operations of Marginal Fields in Nigeria (“2020 Guidelines”) and accompanying Explanatory Notes to the Guidelines for the Award and Operations of Marginal Fields in Nigeria (“Explanatory Notes”) which set out the specific procedure for prequalifica-tion and submission of bids, the award of winning bids and the post award conditions.

Some of the strategic objectives of the Bid Round include growing production capacity of petroleum products by expanding the scope of participation in Nigeria’s petroleum sector through diversification of resources and inflow of investments and promoting indigenous participation in the sector thereby fostering technological transfer to Nigerian companies and individuals.

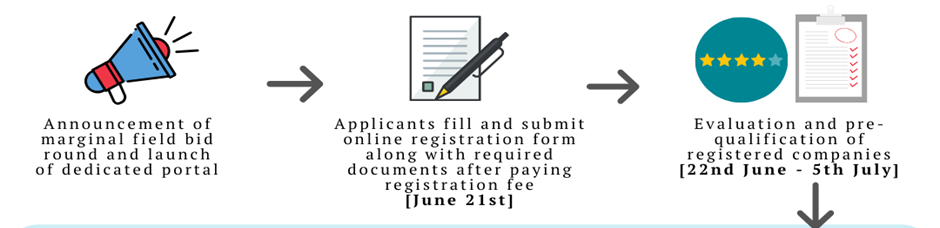

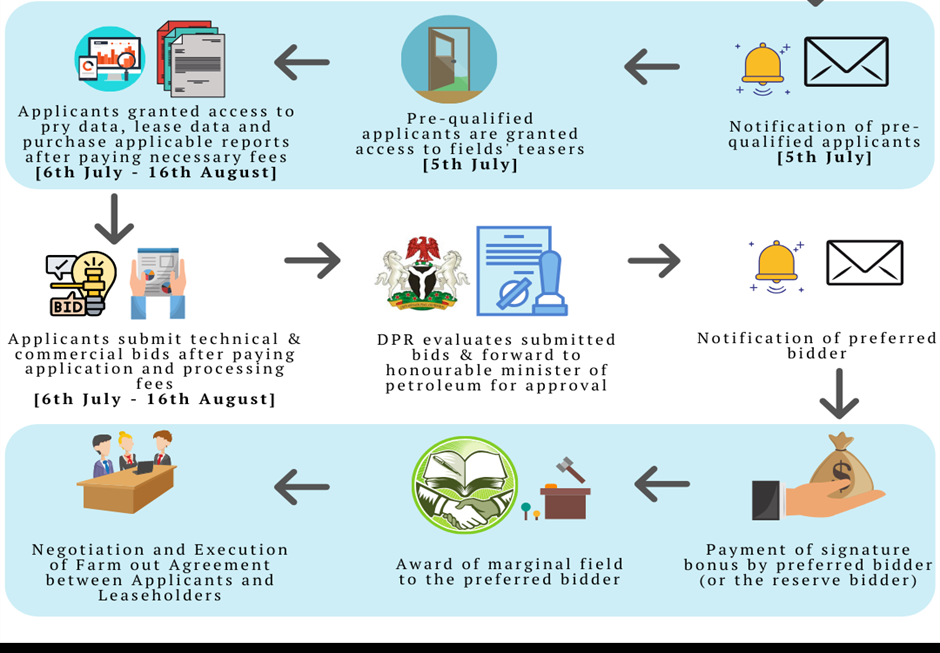

12 STEPS IN THE AWARD OF FEDERAL GOVERNMENT’S 2020 MARGINAL FIELD BID ROUND

The schematic below highlights the steps that are involved in the award of the Marginal Fields by the Nigerian Federal Government this 2020 and the timeline for achieving some of the milestones.

KEY COMMERCIAL CONSIDERATIONS

Some of key considerations for prospective bidders, investors and lenders in this Bid Round include the following:

- PENDING LITIGATION AND CLAIMS

Prospective bidders must conduct their due diligence to ensure that the fields they are interested in acquiring are not subject to litigation by the previous owners, lenders or any other interested persons. This ensures that they are not inheriting any legacy issues which may hinder the development of the field.

It is interesting to note that the Bid Round involves

fifty-seven (57) Marginal Fields, eleven (11) of which were repossessed from the previous owners by the DPR in April 2020 through the purported revocation of their oil firms’ licences to operate the Marginal Fields. The Federal High Court has however restrained the Federal Government from selling or accepting bids for eight (8) Marginal Fields out of the fifty-seven (57) fields and has further granted the present licence holders development rights to the affected fields pending the determination of ongoing litigation challenging their status. In this regard, the DPR has now clarified that the Marginal Fields under litigation will not form part of the Marginal Fields listed for this Bid Round.

| S/N | Exempted Marginal Fields | License Holders |

| 1. | Ofa OML 30 | Independent Energy Ltd |

| 2. | Tom Shot Bank OML 14 | Associated Oil and Gas Ltd/ Dansaki Petroleum Unlimited |

| 3. | Atala- OML 46 MFOG-2C | Bayelsa Oil Company Ltd |

| 4. | Ogedeh OML 90 MFOG-2D | Bicta Energy and Management System Ltd |

| 5. | Ke OML 90 MFOG-2E | Del Sigma Petroleum Ltd |

| 6. | Oriri OML 88 MFOG-2F | Goland Petroleum Ltd |

| 7. | Tsekelewu OML 40 MFOG-2G | Sahara Energy Ltd/African Oil and Gas Ltd |

| 8. | Akepo OML 90 MFOG-2H | Sogenal Ltd |

2. VALUATION CHALLENGES

The valuation of the oil and gas reserves in a Marginal Field and all key assets in relation to the field is a paramount consideration as the determination of the actual value of these assets will enable the bidders put a price tag on the assets and also forms the basis for the technical and commercial bids. Also, proper valuation will assist the bidders and investors in ascertaining how much capital expenditure will be required to develop the field to profitability.

However, there appears to be no indication under the 2020 Guidelines that the bidders will have the opportunity to physically inspect their specific fields of interest but will rather be required to rely on existing data on the fields of interest and subsequently lease such data. In view of the precedent issues from the privatization of the power sector in 2013 which has now thrown the succession companies and their investing purchasers in a state of technical insolvency because they acquired assets on the basis of unreliable data and were unable to physically investigate the assets during the bid process due to labour restiveness. Consequently, the availability of sufficient and credible data to be provided by DPR and thorough independent investigations that involve engagement of experts will be required to be undertaken by bidders and investors to ensure that they are well informed and the technical and commercial bids are well priced based on attendant risks.

3. FINANCIAL CONSIDERATIONS

The ability of prospective bidders to secure adequate funding for the acquisition of the Marginal Fields, their development to the point of production and their operation and maintenance is a key factor to the prequalification of prospective bidders. Under the 2020 Guidelines, prospective bidders are required to provide evidence of their financial capability i.e. verifiable sources of funding the petroleum operations which may include Memorandum of Understanding of financial support from reputable financier(s), parent company guarantee, company balance sheet or bank guarantee. Hence, while qualification for the Bid Round requires that bidders are indigenous companies, there is an avenue for foreign investment through technical partners and other third-party financiers, provided that upon the grant of the award, not more than 49% interest of the interest awarded can be granted to another party by the winning bidder.

4. FOREIGN EXCHANGE CONSIDERATIONS

In alignment with standard practice of transactions in the oil and gas sector being priced in United States Dollars (“USD”), the 2020 Guidelines have provided that certain payments to be made by bidders under the Bid Round are to be paid in USD. However, this is likely to pose a challenge for prospective indigenous bidders in view of the current foreign exchange (forex) volatility in Nigeria. This is evidenced by the different rates at which forex is being sold at the multiple forex markets in Nigeria ranging from N361 per 1USD at the Central Bank of Nigeria Window to N450 per 1USD at the Parallel Market.

5. CHOOSING THE RIGHT PARTNERS

Oil and gas E&P operation is a very technical endeavor which requires high technical competence and managerial capability on the part of any operator of an oil and gas field. In this regard, the 2020 Guidelines require the prospective bidders to demonstrate the ability to fully meet the objective of undertaking expeditious and efficient development of the Marginal Fields. Consequently, prospective bidders are required to either be active in E&P operations or have experience in the upstream oil and gas industry or provide evidence of relationship with a competent technical partner with experience in E&P operations. Therefore, partnerships with foreign technical partners will be instrumental in the bidders mitigating the attendant risks that are involved in the project.

It is important to note that DPR reserves the right to conduct due diligence on the technical partners, therefore, prospective bidders are advised to undertake adequate due diligence on prospective technical and financial partners prior to the execution of any binding agreements to ensure that such partners have the requisite experience in oil field development and operation.

6. IMPACT OF COVID-19

The ongoing COVID-19 pandemic has greatly disrupted business activities and operations across different sectors of the Nigerian and global economy. This is likely to impact on the process for the Bid Round.

The impact of the pandemic as it relates to local and international travel restrictions is also expected to hamper the ability of prospective bidders to conduct physical inspections and valuations of the Marginal Fields, meet with regulatory authorities that are involved in this Bid Round and their investors. In this regard, it is yet to be seen how the entire process of this Bid Round will be conducted virtually.

7. FALLING PRICE OF CRUDE OIL

The combined effect of the COVID-19 pandemic and the Russia-Saudi Arabia oil price war have resulted to the fall in oil prices due to subdued demand foreseen. This has resulted in project delays and Capex reductions in upstream projects globally. The impacts of the pandemic, such as the oil price volatility, are likely to last for a period of time following the pandemic. Therefore considering the huge cost of investments involved in the acquisition and the development of these oil fields and couple with the fact that renewable energy solutions have been gaining inroads and reducing the demand for fossil fuel, this may impact on the financial viability of such projects in the view of prospective foreign partners and financiers investments.

8. ELIGIBILITY TO PARTICIPATE

Under the 2020 Guidelines, prospective bidder companies (including their promoters) that are indebted to the Government, or that currently have assets that are not being operated in a business-like manner will be rendered ineligible to participate or to be pre-qualified for the Bid Round. Interestingly, neither the 2020 Guidelines nor the Explanatory Note define the term ‘business-like manner’, therefore the term may be opened to DPR’s subjectivity/interpretation in determining bidders’ eligibility. Regardless of the issues this may throw up, prospective investors, partners and financiers are advised to conduct due diligence on the bidding companies that approach them with a view to ascertaining their creditworthiness and to also ensure that they are not blacklisted.

9. PRICING

The following are the fees payable by bidders in the Bid Round process:

| S/N | DESCRIPTION | AMOUNT |

| 1. | Registration Fee | N500,000.00 |

| 2. | Application Fee | N 2,000,000.00 per field |

| 3. | Bid Processing Fee | N3,000,000.00 per field |

| 4. | Data Prying Fee | US$15,000.00 per field |

| 5. | Data Leasing Fee | US$25,000.00 per field |

| 6. | Competent Persons Report | US$50,000.00 per field |

| 7. | Field Specific Report | US$25,000.00 per field |

| 8. | Signature Bonus | To be specified in Notice of Preferred Bidder Status |

Prospective bidders must ensure that they have put adequate measures in place to meet these funding obligations. Interesting to note is the significant upward increase in the fees payable under the 2020 Bid Round, compared to those that where to be paid under the aborted 2013 Marginal Field Round. We consider that the increase in the fees might be government’s strategy of weeding out unserious applicants given the capital intensive nature of Marginal Field development.

10. POST-AWARD CONDITIONS

The Explanatory Notes set out certain conditions which are to be complied with by a successful bidder upon the award of Marginal Field(s). These are set out below:

a) Transfer of Interest Post Award: The awardee must not assign more than 49% interest of the award to another party. It is also noted that any assignment or transfer of interest shall be subject to the approval of the Honourable Minister of Petroleum Resources (HMPR).

b) Termination of Rights of Interest Holder: In the case of a joint venture or consortium of more than one bidder, each party shall be required to meet its obligations in a manner that enables the awardee(s) to progress work on the field. Where the party(ies) fail to do so, the HMPR reserves the right to cancel/withdraw and reassign the interests to the remaining awardee(s) or to a fresh party.

c) Protection of Partnerships: Where the award is granted on the basis of the strength of a technical/commercial agreement between the awardee(s) and competent (foreign or local) technical/financial partner(s), the parties shall ensure commitment and reasonable compliance with the agreement. A failure to do so will allow the HMPR exercise the right to void the award.

d) Dispute Resolution: Awardees shall first refer all operational and commercial disagreements among themselves or between the awardees and their partner(s) post-award to the Nigerian Oil and Gas Alternative Dispute Resolution (ADR) Center in DPR for mediation and resolution.

CONCLUSION

In conclusion, the acquisition of Marginal Fields in Nigeria is a high risk and high reward venture. Consequently, prospective bidders will be required to examine the current realities, undertake a detailed risk analysis at an early stage and put in place the appropriate risk mitigation strategies.

Critical success factors such as field identification (the economic, environmental and social considerations involved), leaning into technical and financial partnerships, and preparing a sound operational plan, are very important for efficiency sake and in order to mitigate against potential difficulties and costs overruns. Furthermore, the contractual structure of project documents, which form the legal basis and define the obligations of parties, are very key to the success of such bids.

Detail Commercial Solicitors is distinct as Nigeria’s first commercial solicitor firm to specialize exclusively in non-courtroom practice. Based in Lagos, Nigeria’s business capital, DETAIL is totally committed to its clients’ business objectives and reputed for dealing with the minutiae. www.detailsolicitors.com