Background

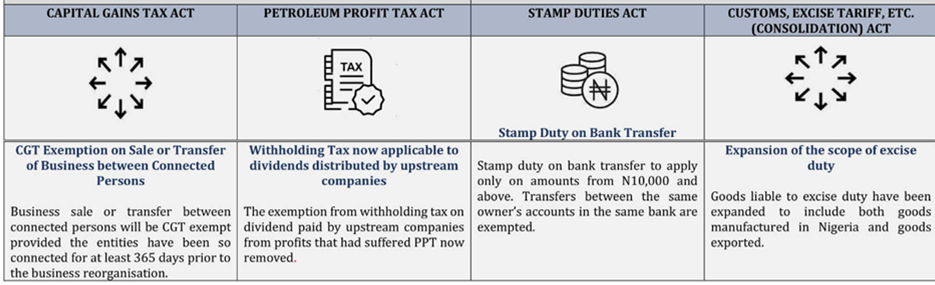

The President of the Federal Republic of Nigeria, President Muhammadu Buhari, recently presented the Nigerian Tax and Fiscal Law (Amendment) Bill, 2019 (the Finance Bill) to the National Assembly for consideration and passage into law. The Finance Bill has been passed by the Senate and is expected to be considered by the House of Representatives, after which it is likely to receive presidential assent. The Finance Bill, by proposing various amendments to the Companies Income Tax Act (CITA), Value Added Tax Act (VAT Act), Petroleum Profit Tax Act (PPT Act), Stamp Duties Act, Personal Income Tax Act (PITA), Capital Gains Tax Act and Customs, Excise Tariff, Etc. (Consolidation) Act, seeks to achieve the following objectives:

(a) Promote fiscal equity by mitigating instances of regressive taxation;

(b) Reform domestic tax laws to align with global best practices;

(c) Introduce tax incentives for investments in infrastructure and capital markets;

Image courtesy one.comodo.com

(d) Support small businesses in line with the ongoing ease of doing business reforms; and

(e) Raise revenue for government.

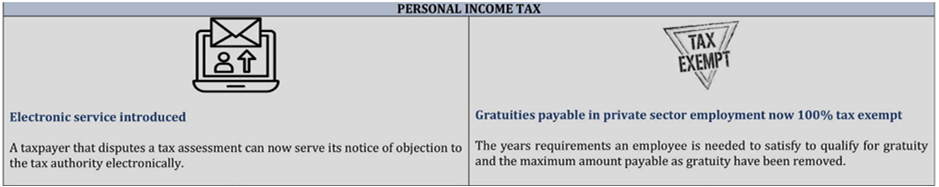

This article provides an analysis of key changes introduced by the Finance Bill in the laws highlighted above and the potential impact of the Finance Bill on Nigerian businesses. The article will also provide some recommendations on the next steps particularly with respect to the implementation of the Finance Bill.

Potential Changes in Law Pursuant to The Provisions of The Finance Bill

Potential Impact of The Finance Bill on Businesses in Nigeria

(a) Improved Tax Regime for Small and Medium-Sized Companies

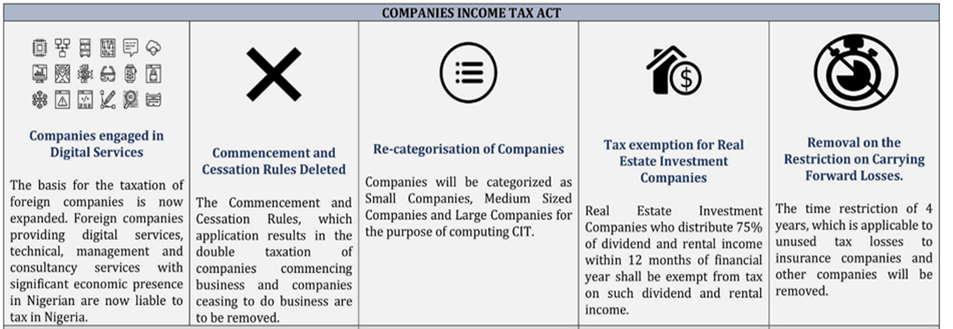

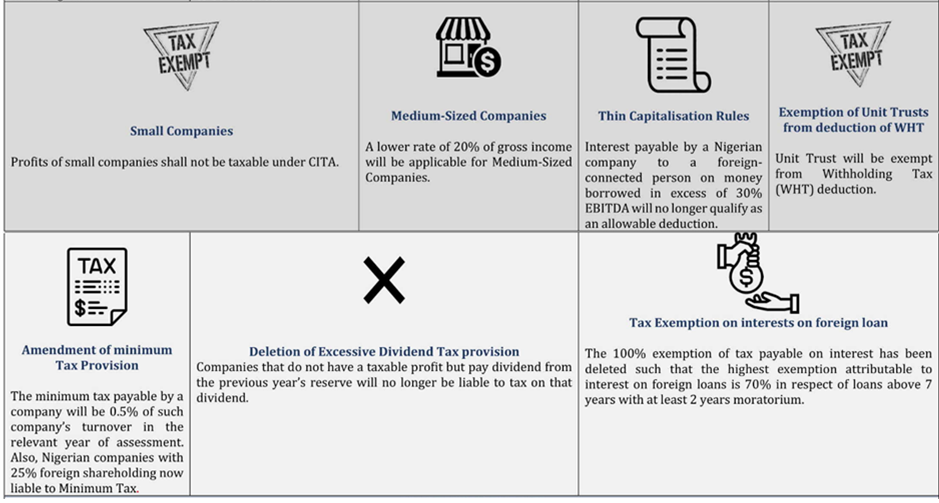

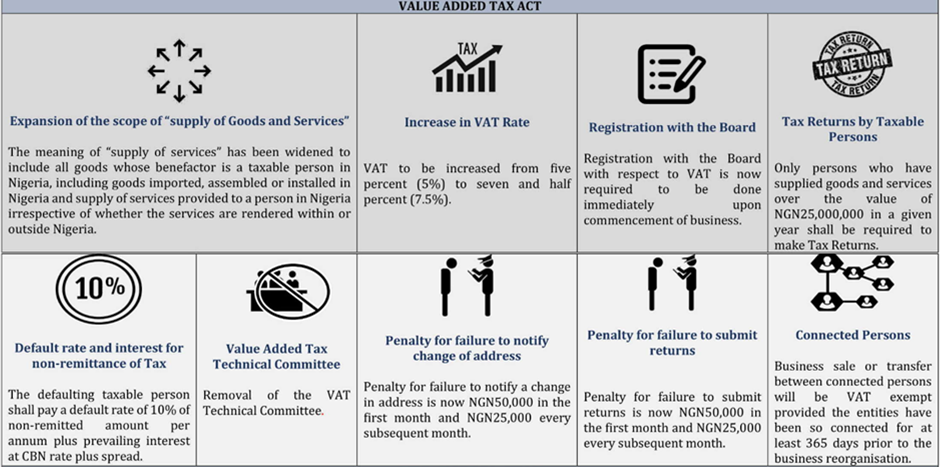

The Finance Bill introduces a new categorization of companies under both the VAT Act and CITA: (i) Small Companies, which means companies with gross turnovers of not more than NGN25,000,000.00; (ii) Medium-Sized Companies, which means a companies with total turnovers of more than NGN25,000,000.00, but not more than NGN100,000,000.00; and (iii) Large Companies, which means companies with turnovers above NGN100,000,000.00. In addition, the Finance Bill seeks to introduce new tax rates applicable to each category of the companies identified above, such that Small Companies will be exempt from paying CITA and will not be required to make VAT returns with respect to goods and services rendered. Also, Medium Sized Companies will be liable to Companies Income Tax (CIT) at the rate of 20% of gross income. The proposed tax regime and rates appear to be similar to what is obtainable in other jurisdictions such as South Africa where companies pay taxes on a graduated scale, according to the overall taxable income of such companies. It is expected that this will stimulate the emergence and growth of small and medium-sized companies in Nigeria. This will in turn contribute to improving the economic indices in the country. In addition, the Finance Bill provides a relief to small companies from the rigor and cost associated with tax compliance. Notwithstanding the above, it is important to note that employees of such small and medium-sized companies will still be subject to personal income tax on their earnings.

(b) The Basis of Taxation of Foreign Companies now Expanded

Under the current regulatory regime, we note that a certain degree of physical presence is required for a foreign company to be liable to tax in Nigeria. However, the Finance Bill has expanded the basis for taxation of foreign companies in Nigeria. The Finance Bill seeks to drag foreign companies providing digital services, technical, management, consultancy services into the Nigerian tax net where they are declared to have significant economic presence in Nigeria by the Minister.

(c) No Double Taxation – Excess Dividend Rules

Under the current tax regime, by Section 80(3) of CITA, dividends, when received by a Nigerian company, are deemed to be franked investment income and should not be subject to further tax. However, there has always been the risk that, by Section 19 of CITA, the dividends received by the Nigerian company when redistributed to its shareholders may be subject to CIT at the rate of 30% in the event that the declared dividend exceeds the company’s total profit for the year or where the company did not make any profit and goes ahead to declare the dividend to its shareholders. The right of the tax authority to further subject this dividend to tax has been upheld by Nigerian Courts in plethora of cases, some of which are the case of OANDO Plc. Vs. FIRS and UAC of Nigeria Plc v FIRS. The Finance Bill now resolves this controversy such that excess dividend is to apply only to untaxed distributions other than profits specifically exempted from tax and franked investment income.

(d) Recognition of Carrying Forward Losses

One of the problems facing Nigerian companies, particularly insurance companies is the four-year time restriction beyond which such companies are not permitted to carry forward their business losses for the purposes of determining their CIT liabilities. However, CITA was amended in 2007 perhaps with a view to removing this restriction, amongst other amendments but failed to achieve this purpose. More particularly, the provision of section 16(7) of CITA that restricts insurance companies from carrying forward their losses beyond four years is not deleted. On the other hand, two provisions of CITA (which are section 31(2)(a)(ii) and (iii)) restrict other types of companies from carrying forward their losses. However, section 31(2)(a)(iii) was deleted by the CITA amendment of 2007, while section 31(2)(a)(ii) was perhaps inadvertently retained and not deleted. Going by the proposed amendment to CITA in the Finance Bill, all companies will now be entitled to carry forward their losses unrestricted.

Therefore, the proposed amendment will no doubt strengthen foreign investment incentives and encourage the growth of businesses in sectors that are not otherwise immediately profitable but profitable in the long run.

(e) Introduction of Thin Capitalisation Rules

Under the current Nigerian regulatory regime, there are no provisions on thin capitalization rules. However, the Finance Bill now seeks to introduce thin capitalisation rules such that interest on loans advanced by connected foreign companies to their Nigerian affiliates and subsidiaries will only qualify as an “allowable deduction” where such interest does not exceed 30% of earnings before interest, tax, depreciation and amortisation (EBITDA) of the Nigerian companies. The thin capitalisation rule, however, does not apply to Nigerian banks and insurance companies with foreign connected affiliates/subsidiaries. With this introduction by the Finance Bill, the tax planning practice whereby many foreign companies shift away profits from Nigeria by providing loans to their Nigerian subsidiaries (which may have no economic justification) and in return receive interest from these companies, thereby reducing the taxable profits of these Nigerian companies will be put to check or reduced.

(f) Increase in VAT Rate:

The current rate of VAT in Nigeria is 5%. However, the Finance Bill seeks to increase the rate to 7.5%. This increase will no doubt have an adverse impact on the cost of VAT-able goods and services that are consumed in Nigeria.

Recommendations

We applaud the initiative taken by the Executive to introduce the Finance Bill to, among other things, amend the tax laws and make them more responsive to the tax reform policies of the Federal Government and enhance its implementation and effectiveness. However, we advise that notwithstanding that the Executive is keen to push the said tax reforms, it is important that the National Assembly undertakes a wholistic review of all the tax laws that will be affected by the provisions of the Finance Bill. It is imperative that such review is done to ensure that there are no inconsistencies across the federal laws as a result of the amendments and introductions made by the Finance Bill. Such a review would have been easier had the amendments been made via separate amendments to the applicable tax laws e.g. an amendment to CITA, an amendment to the VAT Act, etc. However, a wholistic review is still very feasible irrespective of the format the amendments and introductions have taken, i.e. in the Finance Bill.

From an enforcement perspective, given that this is a major shift from what currently obtains, the Federal Inland Revenue Service (FIRS) will be charged with ensuring compliance by existing business entities and emerging entities particularly with respect to taxation of foreign companies engaged in digital services or technical and consultancy services with significant economic presence in Nigeria. We note that the bulk of company assessment, enforcement and compliance by the FIRS is done via physical inspection and verification of the books of companies. Therefore, given that the companies engaged in digital services or providing technical and consultancy services will not have physical presence, it is important that expertise is developed internally within the FIRS to adequately ensure compliance of the newly included taxable companies.

Detail Commercial Solicitors is distinct as Nigeria’s first commercial solicitor firm to specialize exclusively in non-courtroom practice. Based in Lagos, Nigeria’s business capital, DETAIL is totally committed to its clients’ business objectives and reputed for dealing with the minutiae. www.detailsolicitors.com.